May 2012 Newsletter

In this edition:

Changes to the taxation of car fringe benefits

Over a four-year period, taxation of the fringe benefit provided by a company car will move from a sliding scale to a single flat rate.

A fringe benefit refers to a benefit provided by an employer to an employee (or their associate, such as a family member) in respect of their employment. The most common fringe benefit provided by employers to employees is the company car.

In relation to car fringe benefits these can be provided to employees by way of cars owned or leased by the employer given to the employee to use for work and private purposes and also under novated lease arrangements. Once it is identified that a car fringe benefit has been provided to an employee there are two methods which can be used to determine the taxable value of the private benefit received by the employee

There is the operating cost method which requires that the employee maintain a log book for a 12 week period to determine the nature of their use of the vehicle to determine a proportion which represents the private benefit received. It is this proportion that will be assessable fringe benefits tax.

The second method is the statutory cost method and presumes a taxable proportion based on the number of kilometres travelled during the relevant period. In relation to car fringe benefits provided before the 10 May 2011 in which there is a commitment to continue to provide the car benefit after this time the taxable proportion (also referred to as the statutory percentage) is determined as follows:

| Total kilometres travelled in FBT year | Statutory % |

|---|---|

| 0 - 14,999 | 26 |

| 15,000 - 24,999 | 20 |

| 25,000 - 40,000 | 11 |

| Over 40,000 | 7 |

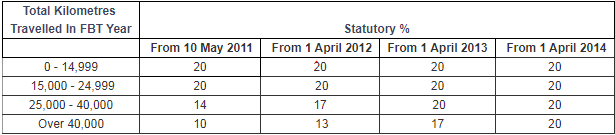

In relation to any car fringe benefits provided to employees for the first time after the 10 May 2011 or to car benefits provided before this time to which a change has been made after this time the statutory rate is a single flat rate of 20% regardless of the kilometres travelled. The move to one statutory rate will be phased in over 4 years as follows:

In the past the use of the statutory method may have been desirable due to the administrative ease of not having to maintain a log book. However with the change it will become relevant for the car benefit provided to employee's to be reassessed and a log book maintained in some instances in order to more accurately reflect the real benefit provided to employees. If you feel that these changes affect you or your business please feel free to contact our office so that a member of our staff can help you work through how the changes will specifically affect you.